When looking for the right crowdfunding platform, you need to choose which one will benefit you. You have several exceptional crowdfunding platforms such as Kickstarter, Indiegogo, Patreon, and Causes, to name a few. But if you are in need of a real estate investing platform, you should set your eyes on DiversyFund. You can find many exciting benefits of the platform, along with a few other downsides that you will encounter.

Who Gets to Use DiversyFund?

Back then, only wealthy people had the opportunity to invest in alternative investments. It was impossible for people in the lower class to invest until a new amendment in 2015 was done to the JOBS Act that made it possible to invest in REITs even if you were not an affluent, accredited investor.

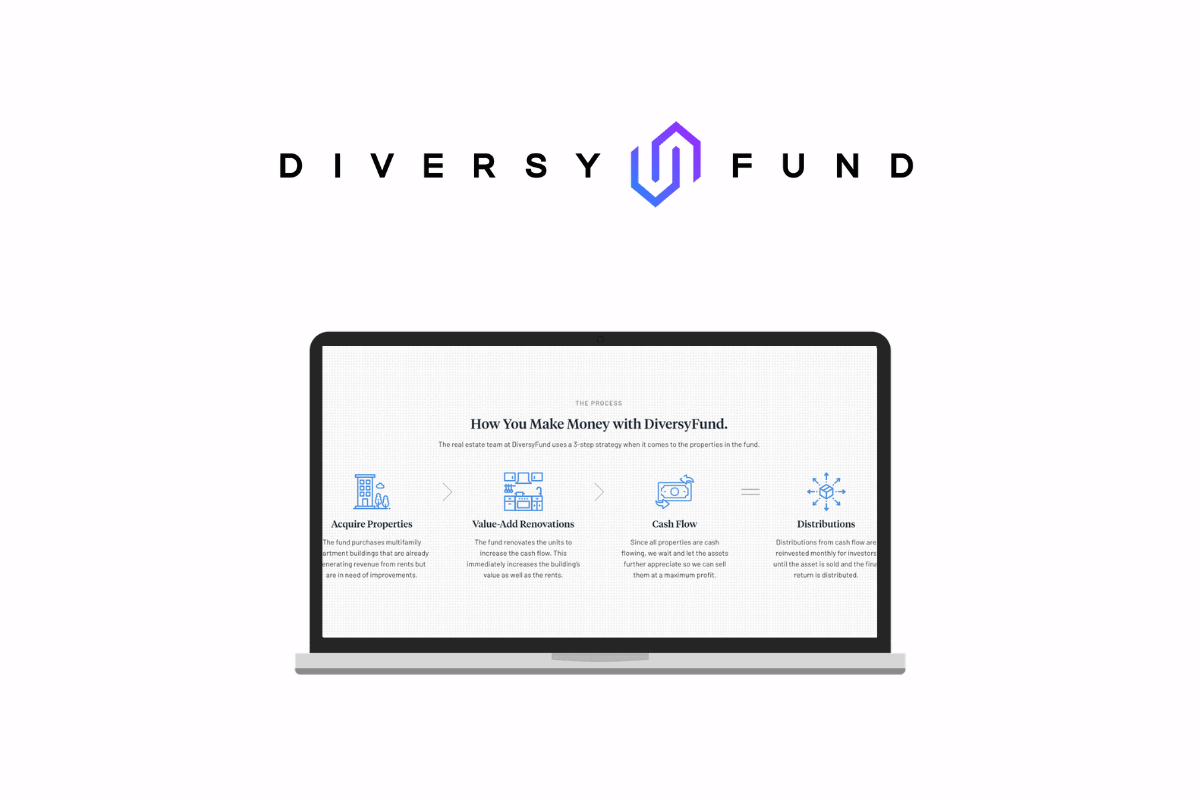

The DiversyFund Growth REIT gives many investors the chance to invest their money in value-add real estate projects and can provide a different way to value invested capital through multifamily properties. If you are a non-accredited investor who wants to branch out your investments beyond bonds and stocks, you should highly consider DiversyFund.

DiversyFund Fees and Payments

Since you now know that you do not need to be an accredited investor, DiversyFund’s minimum investment requirements are only a mere $500. You should also know that investors have no fees, according to their website. However, you can also find that DiversyFund disregarded a 2% annual management fee.

You should also know that DiversyFund does not charge a sales commission. If you want to learn more about how the company makes money, you can watch their Series A presentation that gives you everything you need to know about their underlying money-making ways. The presentation also gives a proper explanation about how they can raise 100 times more income per dollar compared to other real estate platforms.

CEO and founder of DiversyFund Craig Cecilio posing in a black and white photo in an office.

DiversyFund Tools and Platform

Creating an account with DiversyFund is as easy as using your LinkedIn or Facebook account. If you do not prefer to use your other social media accounts, you can also create one on their website by typing in your first name, last name, phone number, zip code, and preferred email address. After writing down your personal information, you will be asked to create a password, confirm it, and add a referral code.

Once everything is finished, you have a full view of your investment performance by checking it on your DiversyFund Dashboard. You can use it to track your overall current invested value and go over your portfolio whenever you want. You will also be able to receive quarterly investment details and yearly tax documents.

Overall, you can say that DiversyFund is the best for people who do not have thousands of dollars to throw in investments. But with the benefits mentioned above, you will also have minor issues, including only a single investment option, and you can only access “blind pool” investments. Make sure you decide before you move forward with using the DiversyFund platform.