When you need to pay off your bills or receive money, you will notice that there is always a routing number. It is crucial to identify a financial institution in a transaction. But have you ever wondered how Frontwave uses its routing number? Some think that it is just a number that no one should pay attention to, but that is where they are wrong.

What is a Routing Number?

If you are new to transacting or paying to a bank, you should know that they have routing numbers. Banks will always have routing numbers because they are used to identify each other during wire transfers. Others refer to them as ABA numbers or transit numbers, and they should always have nine digits. A good example is routing number 000055554, containing at least three parts with a specific meaning.

• 0000 – The first four numbers are The Federal Reserve routing sign or The Federal Reserve Bank area it is located in.

• 5555 – The second four numbers are for the bank’s identification.

• 4 – The last number is the check digit, which can be calculated from the preceding eight digits. Banks also use the last number to detect errors.

The first bank to come up with the routing number was The American Bankers Association in the early 1900s, and banks have been using it ever since.

Do Banks Have Numerous Routing Numbers?

Some banks, especially Frontwave, only use one routing number. However, there is a special case when it comes to larger banks like Bank of America and TD because they use multiple routing numbers for different regions and states. No need to panic when you see that a bank has multiple routing numbers.

How Do You Find the Routing Number on a Check?

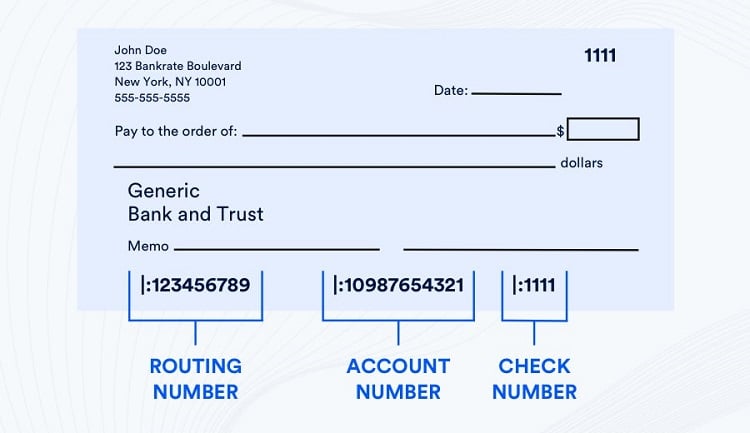

You can check the routing number at the bottom-left of the check. Most of the time, checks will have three crucial sets of numbers printed down the bottom.

• Account number: You can find it at the center, between the check number and the routing number.

• Routing number: You can find it at the left-hand corner of the check.

• Check number: You can find it at the right-hand corner of the check.

Sample of check showing the location of the routing number

Are Routing Numbers Different for International Transfers?

You should know that international transfers do not require routing numbers. Instead, international transfers use a “SWIFT” code. The unique code identifies banks included in international transfers, which generally makes them more worldly routing numbers. You should note that not all credit unions and banks utilize SWIFT codes, and one of them is Frontwave. If you plan on doing an international transfer, you may want to look for another bank aside from Frontwave.

Routing numbers are significant, especially when you need to receive or send money through transferring. You will not have any problems with figuring out Frontwave’s routing number because they only have one!