Famous Stars Who Believe Taxes Are Below Their Status

While celebrities revel in the glamor and sparkle of the spotlight, a darker truth lurks beneath the surface. Some celebrities have opted to avoid paying taxes, demonstrating a worrying disdain for their civic duties.

We’ll examine some of these celebrities who believe taxes are beneath them, casting light on a troubling trend. Join us as we uncover the stories behind these tax evasion scandals, exposing a side of fame that goes beyond the red carpet.

Wesley Snipes

Renowned actor Wesley Snipes, known for his roles in Blade and Demolition Man, faced legal trouble and found himself entangled in a tax evasion controversy.

Source: Getty Images

Wesley was convicted of three misdemeanor counts of failing to file tax returns and was sentenced to three years in prison in 2008. He was also fined $9.5 million. In 2018, he lost a $23.5 million tax case and offered the IRS a tiny 4% compromise.

Stephen Baldwin

Continuing the trend of controversy associated with the Baldwin name, Stephen Baldwin, renowned actor and eldest of the Baldwin brothers, faced his tax evasion issue.

Source: @valleydoIl/ Twitter

Stephen Baldwin pled guilty in 2013 to failure to pay $400,000 in taxes. However, luck seemed to be on his side as he avoided jail time by blaming the blunder on “bad advice” from his accountant. Baldwin soon paid the overdue sum, ending his tax problems.

Lauryn Hill

Our next entry in the celebrity tax evasion list takes us to the troubled world of singer-songwriter Lauryn Hill. Known for her powerful vocals and soulful lyrics, Hill faced legal repercussions for failing to pay taxes.

Source: Getty Images

In 2013, Hill served a three-month prison sentence for unpaid taxes amounting to $1.8 million. The unpaid taxes date back to 2005-2007, and her case garnered significant media attention.

Sophia Loren

Famous Italian actress Sophia Loren, known for her mesmerizing beauty and talent, had a brief run-in with tax problems in 1982. Due to an error made by her accountant, Loren served 17 days in jail.

Source: Getty Images

However, it was eventually shown that Loren had indeed paid what she thought she owed, and the error was genuine.

Shakira

In the realm of tax evasion controversies, the Colombian singer Shakira has recently faced scrutiny. She is currently under investigation for alleged tax fraud in Spain, where she resides.

Source: @PopBase/ Twitter

The investigation centers around an alleged evasion of approximately 14.5 million euros. If found guilty, Shakira could face severe consequences, including an eight-year prison term and a substantial fine amounting to 24 million euros.

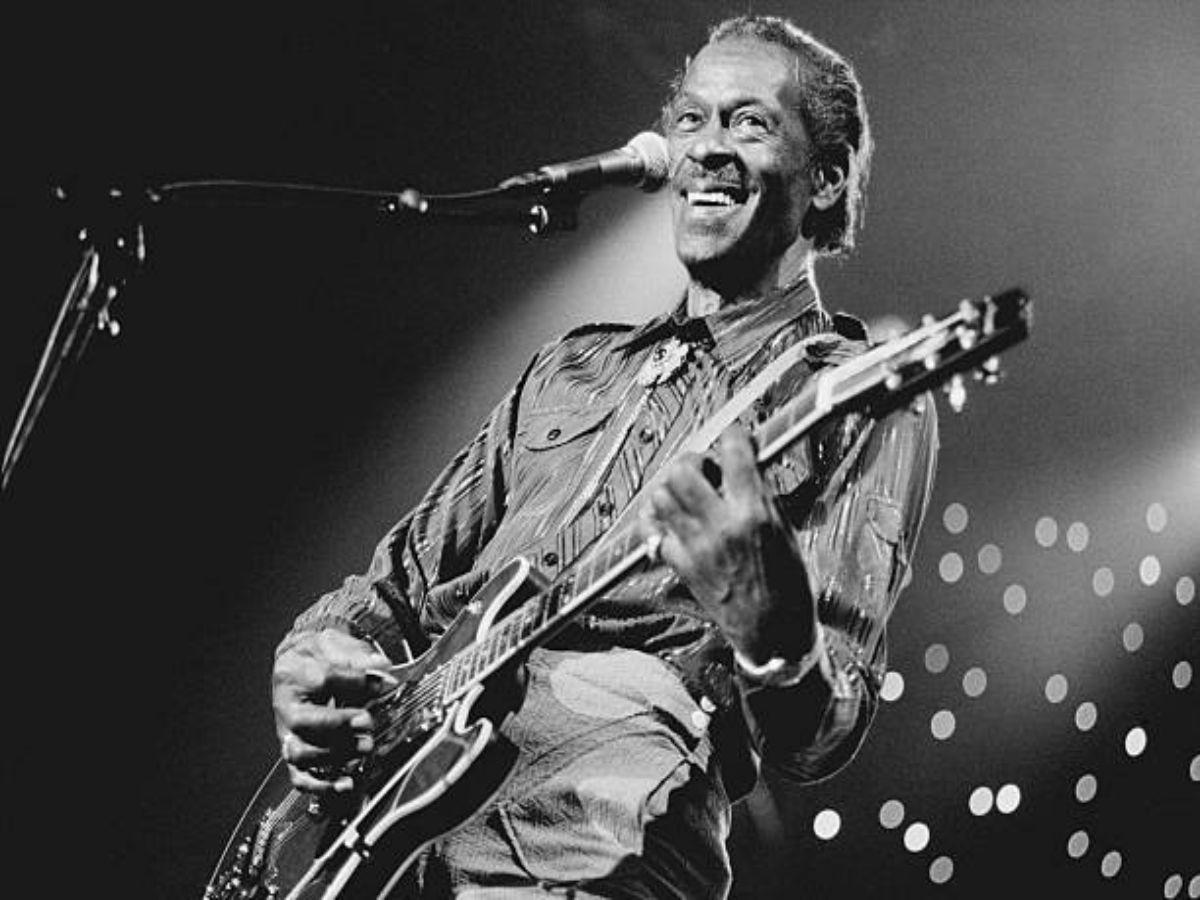

Chuck Berry

Even rock ‘n’ roll legends are not immune to tax problems. Chuck Berry, the prominent musician famous for hits like “Johnny B. Goode” and “Maybellene,” had his fair share of tax problems.

Source: Getty Images

In 1979, Berry pleaded guilty to tax evasion and was ordered to pay over $100,000 in unpaid taxes. He served a four-month prison sentence and 1,000 hours of community service, which he completed by organizing benefit concerts.

Martha Stewart

Martha Stewart, the renowned domestic guru and businesswoman, became engaged in a tax cheating controversy that ruined her enterprise. Stewart was convicted in 2004 of conspiring and making false statements concerning the selling of stock.

Source: Getty Images

While not directly related to tax evasion, the allegations resulted from an examination of her financial dealings. As a result, Stewart received a five-month prison sentence and suffered substantial difficulties to her personal and professional reputation.

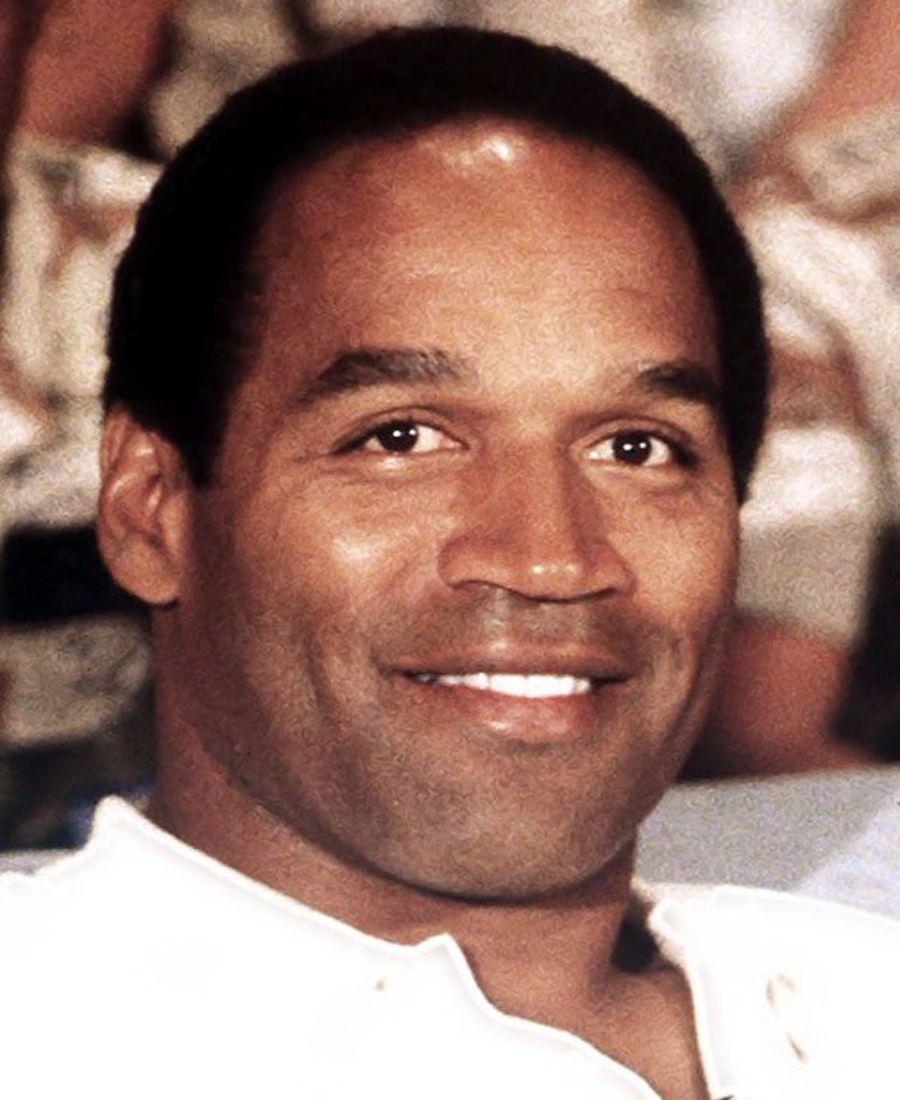

O.J. Simpson

O.J. Simpson, known for his successful football career and later his infamous criminal trial, also faced tax troubles during his life.

Source: @da99andthe2000s/ Twitter

At one point, Simpson found himself on California’s “most delinquent taxpayers” list, owing approximately $1.4 million in back taxes. Despite his legal battles, Simpson managed to evade severe consequences related to his tax debts, much like he did with other crimes he was accused of.

Mike Sorrentino

Reality TV star Mike Sorrentino, famously known as “The Situation” from the hit show Jersey Shore, faced significant tax evasion allegations. Between 2010 and 2012, Sorrentino evaded paying a tax bill of approximately $9 million.

Source: Getty Images

However, he ultimately pled guilty to tax fraud charges and received an eight-month custodial sentence. Sorrentino’s case exemplifies the difficulties that celebrities might face when they fail to meet their tax commitments.

Nicolas Cage

Even Hollywood’s brightest stars can find themselves entangled in significant tax troubles, as demonstrated by the case of actor Nicolas Cage.

Source: @TrontvetScott/ Twitter

Despite his Academy Award-winning career and immense wealth, Cage faced substantial financial difficulties and owed the IRS millions of dollars in unpaid taxes. Reports indicate that his tax debt amounted to a staggering sum of approximately $14 million.

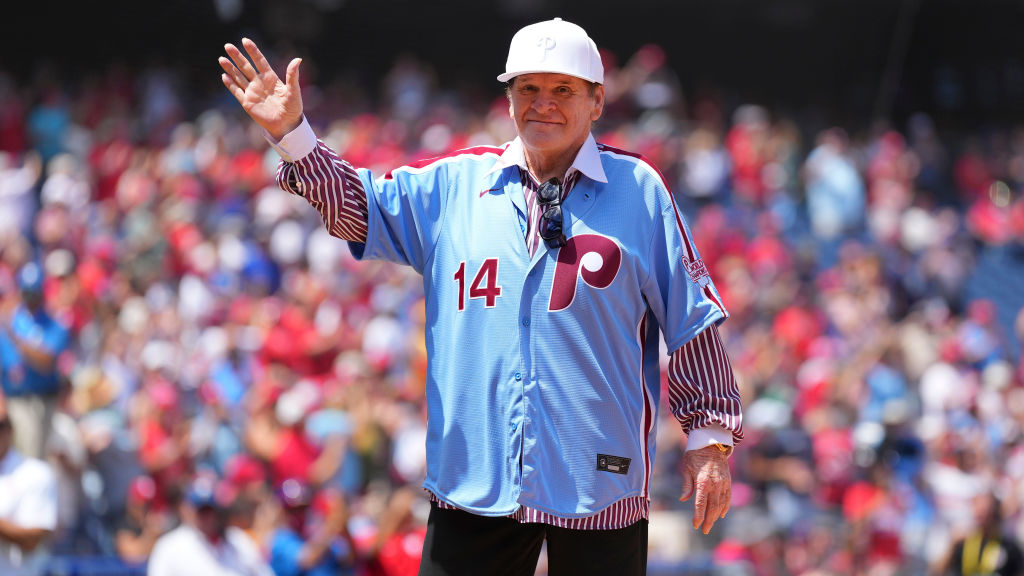

Pete Rose

Baseball legend Pete Rose, known for his illustrious career as a player and later his controversial ban from the game, also faced tax troubles during his life.

Source: Getty Images

In 1990, Rose was convicted of tax evasion for failing to report income from his gambling activities. He pleaded guilty to two felony counts and served a five-month prison sentence. Additionally, he was ordered to pay fines and restitution amounting to over $50,000.

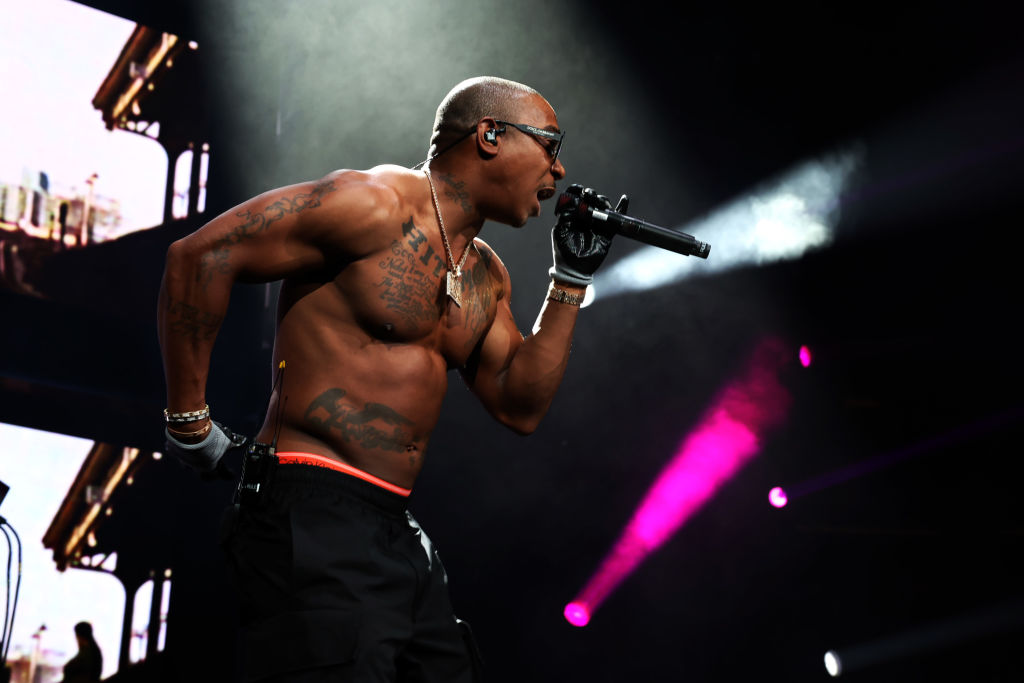

Ja Rule

Hip-hop singer Ja Rule has also had his fair share of tax issues. Ja Rule, actual name Jeffrey Atkins, pleaded convicted to tax evasion charges in 2011.

Source: Getty Images

He neglected to file income tax returns for multiple years, resulting in nearly $3 million in unpaid taxes. Ja Rule was sentenced to 28 months in federal prison and ordered to pay back the delinquent taxes due to his conviction.

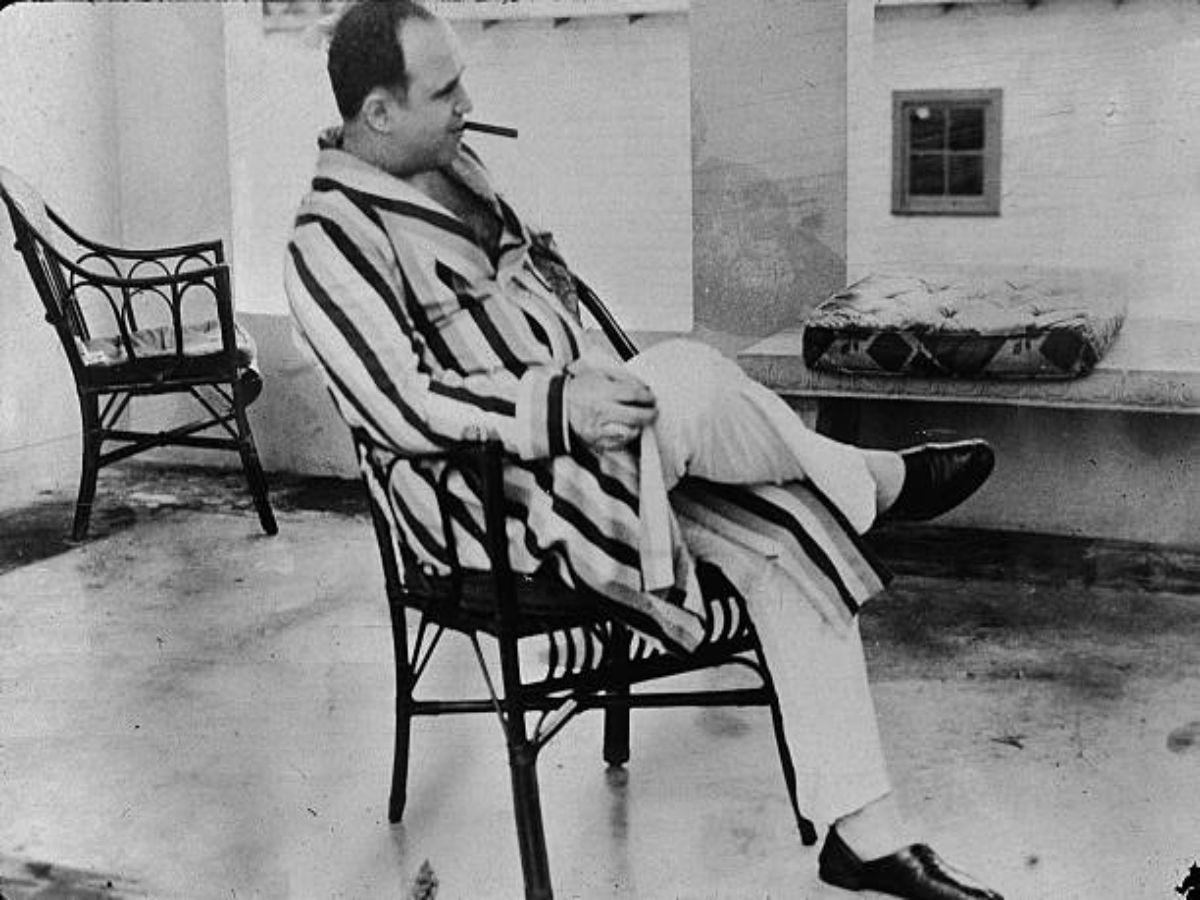

Al Capone

Al Capone, one of the most notorious mobsters in American history, is famously remembered for his criminal activities and his conviction on tax evasion charges. In 1931, Capone was found guilty of income tax evasion, as he had failed to report his illicit income from organized crime activities.

Source: Getty Images

Although he had built a vast criminal empire, his failure to pay taxes ultimately led to his downfall. Capone was sentenced to 11 years in federal prison and had to pay hefty fines.

Heidi Fleiss

Heidi Fleiss, commonly known as the “Hollywood Madam” for her role in a high-profile prostitution ring, had tax issues during her turbulent career. Fleiss was convicted of various offenses, including tax evasion, in 1997.

Source: @Firethrowers/ Twitter

She admitted to neglecting to report large revenue received from illicit activities, resulting in unpaid taxes. As a result of her conviction, Fleiss was sentenced to 37 months in federal prison and required to pay restitution to the IRS for the unpaid taxes.