The US Might Not Be Headed Toward Recession, But the South and West Could Be in Trouble

Experts have weighed in on the possibility of a nation-wide recession in the near future, and they’re reports show that the US economy is doing much better in 2023 than they had originally anticipated.

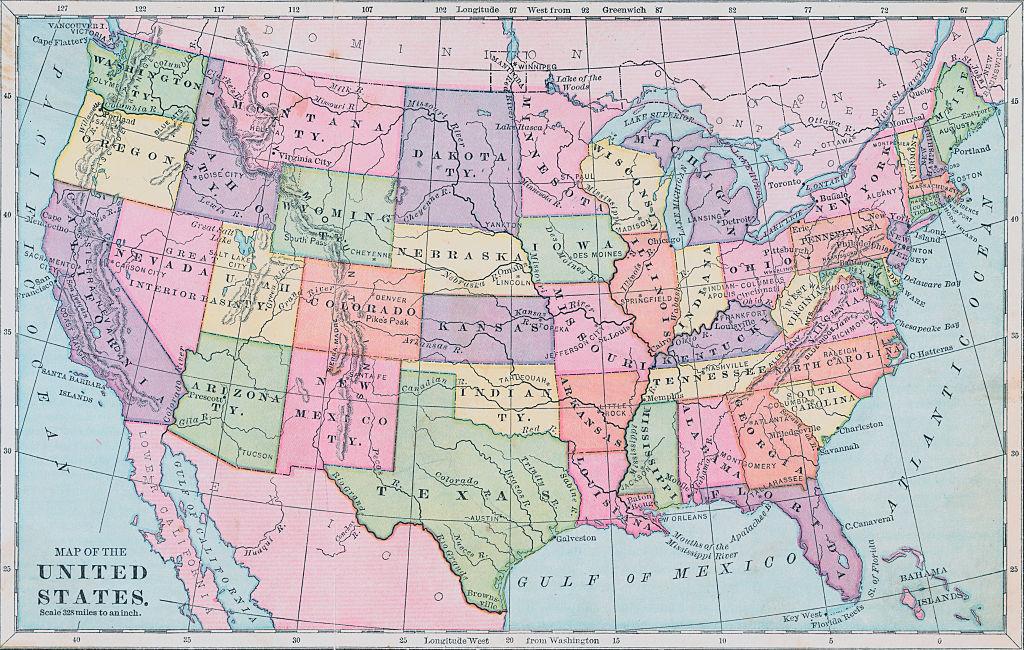

However, there is still a chance of recession in 2024, but if it does occur, it will likely hit the southern and western regions of the country much harder than the northeast and midwestern states.

Let’s Talk Numbers

Earlier this year, financial research showed that the chance of a recession across the USA in 2024 was about 50%, but now, reports state that number has dropped to a 33% chance.

Source: Spencer Platt/Getty Images

According to Moody’s analytics, some metropolitan areas, specifically in the west and the south, are still sitting at 50%. But luckily, the chance of recession has not increased at all in the past six months, and financial experts are hopeful that the country will make it through the next few years more or less unscathed.

How the Pandemic Has Affected the US Economy

It’s important to understand that one of the reasons why the estimated chance of recession was so high was because of the economic consequences of the global pandemic in 2020.

Source: Alfred Gescheidt/Getty Images

While the pandemic did certainly negatively affect the US economy, experts assumed that the troubles it caused would last a whole lot longer than they did. In fact, reports now state that the country has all but recovered from all downturns in 2020. However, one side effect of the pandemic continues to play a role in the economy: Domestic migration.

Domestic Migration Directly Affects the Possibility of Regional Recession

During the pandemic, the majority of Americans worked from home. Even after companies were approved to return to the office, many declined to do so, and today, more than 27% of the employed population work completely remotely.

Source: David Paul Morris/Getty Images

Because millions of Americans no longer need to commute to an office, there has been an incredible amount of domestic migration. Those who once lived in metropolitan cities for work have now moved to rural areas to enjoy a calmer and much cheaper life.

The Housing Market Plays a Big Role in Understanding the US Economy

When it comes to understanding the US economy and the chance of recession, one of the major factors is how the housing market is functioning.

Source: Brandon Bell/Getty Images

The Great Recession of 2008 was directly caused by the housing market bubble burst, so as housing prices increased in recent years, experts were worried the country was doomed to repeat its mistakes.

Some Experts Report Less Hopeful Numbers

Even if the housing market only bursts in one region, it could lead to a nation-wide recession. And many financial sources worry that the increased housing prices will almost certainly lead to an economic downturn next year.

Source: Mario Tama/Getty Images

Some forecasters have stated that there is still a 48% chance of recession, though that number has significantly decreased from their May prediction of 61%. These experts state that “There’s more risk in places that have grown rapidly.”

Recession Statistics in the West

Home prices in the West, specifically in the Mountain West, have increased by an average of 20.5% since last year.

Source: Gary Hershorn/Getty Images

According to Kamins of Moody Analytics, the increase in home value as well as consumer goods price in the region has put a strain on residents. And although the region is growing, those who live there will struggle to spend, increasing the risk of a local recession.

Recession Statistics in the South

Americans are moving to the south in droves in order to lower their costs of living, and because of the volatile home prices, the current inflation rate in the region is the highest in the country at 4.4%.

Source: Brandon Bell/Getty Images

Mortgage delinquencies in Mississippi, Louisiana, and Alamba are at an all time high, and Moody’s Analytics project a 7.4% decrease in housing prices next year. Once again, increasing the chances of a recession to a whopping 34.7%.

Recession Statistics in the Midwest

The Midwest is experiencing a lower inflation than other regions at only 3.7%, and with modest home prices and a lack of volatility, there’s less of a chance of a bubble burst.

Source: AaronP/Bauer-Griffin/Getty Images

Because factory activity in the region is declining, the region may struggle with employment in the near future. Local manufacturing companies are expected to rebound, but it may affect the Midwest’s economy next year.

Recession Statistics in the Northeast

Many Americans have abandoned the northeast states in search of lower cost of living in the south. According to Kamins from Moody Analytics, the northeast has “just been slow and steady for a while and don’t have as far to fall.”

Source: Rick Friedman/Corbis/Getty Images

Though other sources report that the mass migration away from cities such as Philadelphia, New York, and Boston is actually dangerous for the economy and puts the region at a higher risk than Moody’s is admitting.

The Federal Reserve Is Hard at Work Keeping Consumer Prices Down

In addition to watching housing costs closely, the Federal Reserve is also working hard to keep consumer prices down in order to protect the country against a recession.

Source: Mario Tama/Getty Images

And because of the slowing inflation rates, the Federal Reserve can also halt plans to raise interest rates this year. Both of these decisions will directly decrease the chance of a rescission, and even a slight downturn will be less likely.

Will the USA See a Recession in 2024?

The bottom line is that while a recession next year is possible, it’s becoming less and less likely thanks to the actions of the Federal Reserve, as well as the leveling out of the housing market.

Source: Getty Images

However, there is still a chance that certain areas of the country, specifically in the western and southern regions where mass domestic migration has occurred, may see economic downturn that could result in a nation-wide recession.