When it comes to taking out loans, whether it be for a house, car, tuition bills, and others, your credit score matters significantly. Lenders use credit scores as a measure to decide whether or not they will grant a loan and can affect terms like the interest rates, repayment schedule, or downpayment. Essentially, a good credit score can come with many benefits, especially with financing concerns, so you must manage your credit wisely.

Maintaining a good credit score is crucial to manage your financial health and open up your credit options.

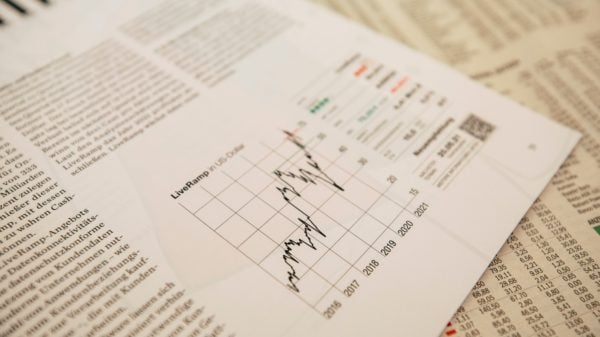

There is no fixed number dictating what a “good” credit score is as it will depend on the credit scoring model used. For example, the FICO score model is the most popular and reputable, with credit scores ranging from 300 to 850. A score ranging from 670 to 739 will typically be considered as good, but lenders may set certain thresholds for their loan terms. Another well-known scoring model is VantageScore, which also has scores ranging from 300 to 850, where 700 is considered to be good credit.

How to Get a Good Credit Score?

Raising and improving your credit score does not happen overnight and will require changes in your habits. Ultimately, if you want to make your credit score good or maintain its current standing, you must take charge and be responsible for your finances. Here are a few steps you can take to help with this:

1. Pay on Time

One of the top habits to cultivate is paying your loans and debts on time. Payment history accounts for 35% of your FICO credit score, so your payment habits will be a huge factor. Whether it be revolving debt, such as from a credit card, or installment debt like a mortgage, you must treat all your debts equally. They can all affect your credit score the same way, so paying your debts on time is a must.

2. Establish a Long History

A long credit history is a positive sign for your credit score, provided that it is consistently a good history. Having this can highlight your experience with loans and debts, in general, giving lenders more confidence about your ability to repay them. Length of history accounts for 15% of your FICO credit score.

3. Apply Only When Needed

While a long credit history can look good for you, it will not be attractive to lenders if you have too much credit in a short time. This can make you look like you are in a bad financial position, thus being a high-risk borrower. New credit applications may make up about 10% of your score, and every time you apply for new credit, an inquiry will show up on your report, causing a temporary decrease to your score. Thus, it is best to minimize your applications at a time and only get a loan when it is absolutely necessary.

4. Review Your Credit Report

Mistakes in your credit report may lead to a lower score, so reviewing your report regularly can prevent this from occurring. Whether it be a misspelled name, incorrect address, or wrong accounts, these factors can all take a hit on your credit score. Thus, if you notice anything that is wrong or out of place, you can contact the credit bureaus to have it fixed.