Estate law is a type of law that concerns a person’s property. It involves planning the property of an individual during their lifetime as well as after. It may involve transactional law and even litigation. Estate law comprises all of the rules that impact how people make their will, decisions, and issues directions about their personal affairs.

What does an estate planning attorney do?

An estate planning attorney has the function of planning the process of probate court during the estate planning. They must know state and federal laws that can have an impact on the estate.

Estate planning attorneys are otherwise known as state law attorneys or probate attorneys. They are experienced and licensed professionals with an extensive understanding of the state and federal laws required to direct assets after an individual’s death. Aside from educating those left behind about the probate process, the estate planning attorney helps assist in the following situations:

• Drafting a will

• Designation of beneficiaries

• Power of attorney

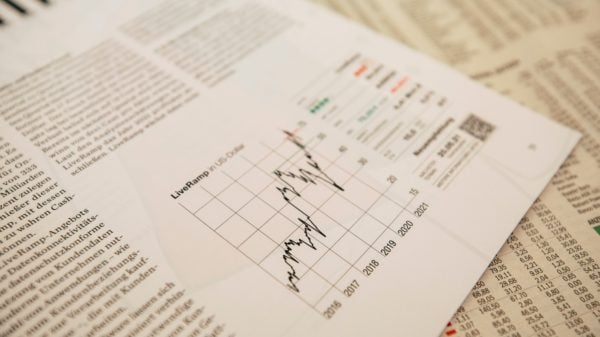

• Reducing and mitigating estate tax when possible

• Avoiding the probate court procedure

If you have considerable assets, you need to protect them both during your lifetime and in the event of an accident. You also need to protect your heirs after your death. It is typical for an estate planning attorney to charge a flat fee to help you plan a binding legal document, including wills and power of attorney. These professionals can also be hired on an hourly basis to help you maintain your estate and do actions on your behalf, especially when handling disputes. It helps ensure that your will is carried out according to your plan whenever required.

An estate planning attorney can also guide a person with a power of attorney over a deceased person’s estate via the process of probate court. In any case, an estate planning attorney should help avoid probate court altogether. However, it will largely depend on the type of assets the disease had and how they should be legally allowed to be transferred to heirs.

Contested wills

However, if the beneficiary or heir believes that she or he should contest a will’s contents, it is necessary to consult with an asset planning attorney at once. In many cases, these kinds of lawsuits drain the estate’s funds.

Federal estate taxes

Over 99% of estates do not owe any federal estate tax, according to a report back in 2018 by the Tax Policy Center. Only estates with a value of over $11,000,000 are required to file as of 2019.

You will require an estate planning attorney for your estate to protect your assets and beneficiaries. Know the law so your wishes will be followed after your death or the case of an accident.

Conclusion

It is crucial to protect yourself and your loved ones if you have sizable assets. Your wealth is your life’s work, and you want your heirs to benefit. It is crucial to hire an estate planning attorney for any legal impediments and challenges to your personal decisions about your estate. While you are still in good health it is crucial to get your documents straightened out so there will be no disputation when the inevitable comes.