This week marked a significant move by the Biden administration: the cancellation of student loan debt for over 804,000 federal student loan borrowers. The announcement came after it was identified that many individuals, despite qualifying for loan relief as per their repayment plans, had not received their due benefits owing to administrative discrepancies.

The process began on Monday when a large number of borrowers received emails from their loan services stating that their student loans had been forgiven. ABC News reported on this development after procuring a copy of the confirmation notices sent to the borrowers.

Of the entire borrower base of over 800,000 individuals, more than 200,000 had their debts cleared by the end of Monday alone, as confirmed by the Department of Education. A deeper look into the numbers reveals that approximately 614,000 borrowers are expected to witness a full cancellation of their student loan debts. However, for some, only certain loans will be forgiven, especially if they had taken out loans at multiple times.

The crux of the relief is focused on those who had opted for income-driven repayment (IDR) plans. These plans, designed by the federal government, allow for student loan debts to be canceled after consistent payments have been made for a period of 20 or 25 years, contingent on the specifics of the plan. But, due to inaccuracies in tracking payments, many borrowers who were enrolled in the IDR plans found themselves still making payments beyond their stipulated end dates, without any foreseeable debt forgiveness.

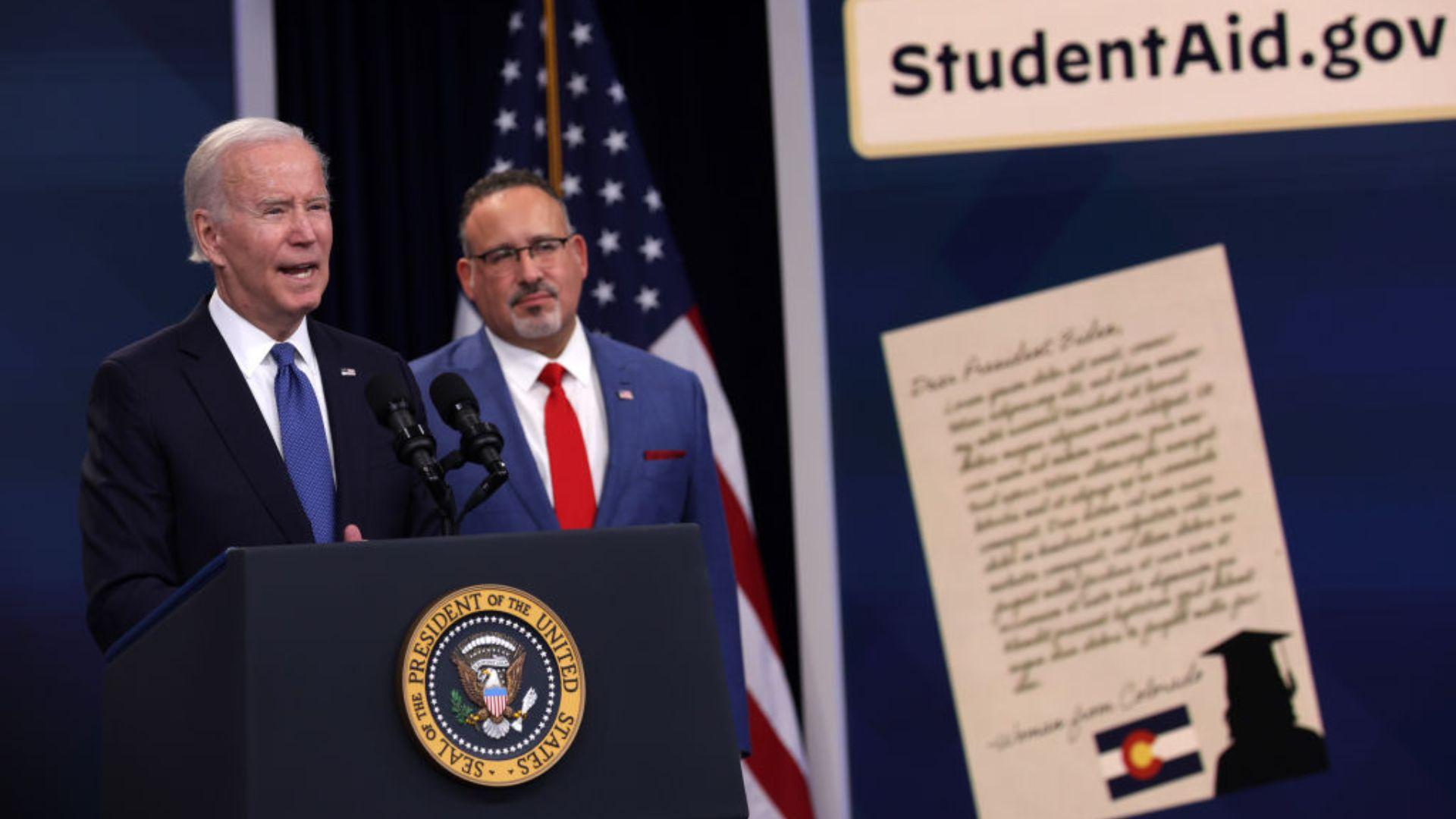

President Joe Biden addressed these administrative shortcomings, stating, “Under these plans, if a borrower makes 20 or 25 years’ worth of payments, they get the remaining balances of their loans forgiven. But because of errors and administrative failures of the student loan system that started long before I took office, over 804,000 borrowers never got the credit they earned, and never saw the forgiveness they were promised – even after making payments for decades.”

He added that he was determined to rectify this lapse. Borrowers impacted by these failures in the IDR plans should anticipate emails with the message of their loans being forgiven in full by the Biden-Harris Administration.

While the relief process is anticipated to conclude within a few weeks, there is a chance that legal proceedings could pose interruptions. One such lawsuit, claiming the Department of Education was overstepping its bounds, was recently dismissed by a U.S. district court judge in Michigan.

Secretary of Education Miguel Cardona elaborated on the administration’s stance, “We are standing up for borrowers who did everything right, but whose progress toward forgiveness went uncounted due to past administrative failures that the Biden-Harris team has worked tirelessly to correct.”

In terms of figures, the adjustments to the IDR plans by the Department of Education are slated to culminate in $39 billion of automatic debt relief, as previously reported by ABC News.

The debt relief announced was not without its critics. Some, like Republican Rep. Virginia Foxx, see it as a misuse of taxpayer money. However, others like Persis Yu from the Student Borrower Protection Center, commend the relief as “delayed justice.”

Conclusively, this student loan forgiveness is part of a broader initiative by the Biden administration, which has so far declared a total debt relief of $116.6 billion, benefiting more than 3.4 million borrowers.